Client Management

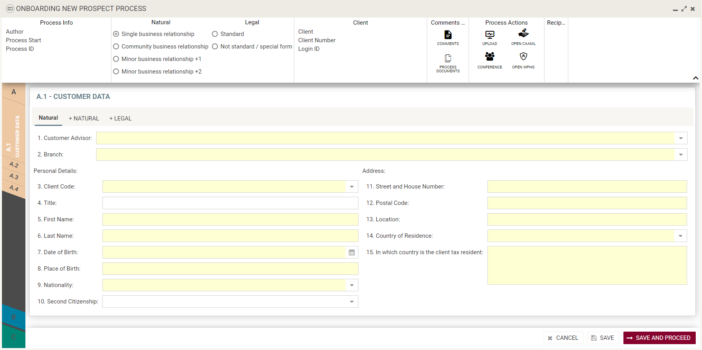

Onboarding – Client Onboarding and continuous management process

- Client Legal Data

Capturing and changing of legally relevant client data. Support of different legal entities (natural persons, legal persons, joint and group accounts). - Customer Identification

Support of Video Ident and other identification procedures. Fully regulatory compliant solution with the integrated Arena Web Meeting. TAN transmission and check. - Product Center

Supports all contractional documents with a product specific workflow to fill the form and receive all needed management approvals. - Integrated Form Center

Encompasses a complete set of legal forms together with version control, multi-language capability and an activation process based on the 4 eyes principle. - Welcome Package

The onboarding process stays open until all mandatory steps are successfully finished. Subsequently, a welcome package containing an aggregation of all client related forms and information is ready to be handed out to the client. - Offboarding Process

Supports closing the client relation with a set of integrated follow-up steps.

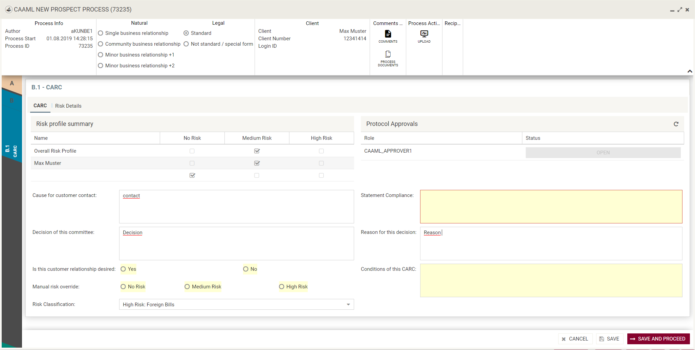

CAAML – Client Acceptance & Anti Money Laundering

- Business Process

BPM-supported workflow, which integrates the checks of Bad Press and World Check as PDF upload and enables the upload of additional information. The decision of the risk committee (CARC) is logged in the system, actions and comments of all users are archived (audit trail). Various management reports can also be defined. - Risk Assessment Form

The detailed documentation of the customer is done in a fully adaptable risk assessment form (RAF) with a risk classification system that is transparent at all times. Risk Assessment Form questions can be added, edited and deleted, and each question can be assigned with its own risk impact. - Automation

The cyclical triggering of review processes is automated, with the cycle being adjustable, depending on the risk profile. Both, review cycle and country risk table can be configured in the frontend. Users are automatically notified of pending process tasks to be performed by them.

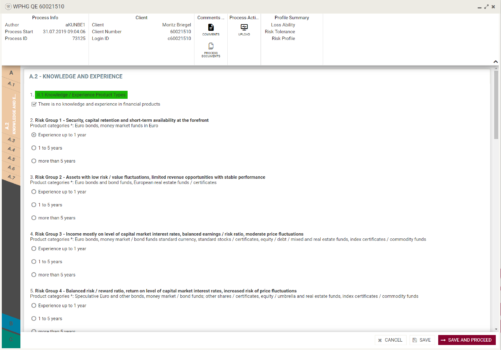

KYC and Investor Profile Questionnaire: Client Profiling Process

- Business Process Content

KYC and Investor Profile Questionnaire encompasse the entire client profiling to fulfil legal requirements of MiFID with regards to appropriateness and suitability structuring the following information:- personal data

- client risk

- investment period

- financial situation

- knowledge and experience

- third party products

- Supported Legal Structures

The process supports natural and legal persons and recognizes different roles of legal clients, power of attorney and authorized representation in complex structures with minors or persons who are not contractually capable as well as joint accounts in conjunction with AND and OR relations. - Form Shipment and Client Feedback

Full support of an end-to-end business process including client specific dispatch of Investor Profile Questionnaire forms and electronical client acceptance via client postbox integrated with the KYC and Investor Profile Questionnaire process.

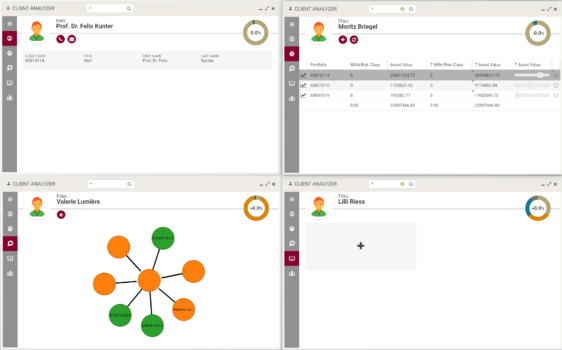

Customer and Prospects analysis – All your customers and prospects at a glance

- Customer Profiles

Here you will find all functions that support you in customer acquisition and customer care, such as the graphic display of internal and external customer relations (joint accounts, power of attorney, family units) and other customer data, as well as storage and analysis of internal and external customer data for systematic cluster and profile creation. - Asset Analysis

This section provides a complete presentation of all internal and external client assets and the clients risk appetite, taking into account portfolio value and risk diversification. - Customer Relationship Management (CRM)

Provides you with tools for monitoring and optimizing your customer relationship by defining goals (activities, campaigns, meetings, points of contact or follow-ups). In addition to an appointment calendar (date, time, subject and goal of the meeting) with reminder function, creation of meeting notes and comparison of set vs. achieved goals, you can set up active monitoring with alerts on numerous events (milestones, market movements and opportunities, portfolio development, missing documents, etc.). The dispatch control for the integration of all customer communication channels can also be configured here.

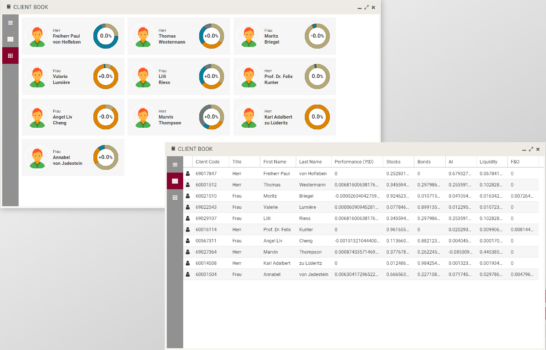

Client Book – Manage and analyze your customer portfolio

- Aggregation

This feature helps you manage your entire client portfolio with all relevant information on holdings and transactions by providing aggregated asset allocation data with tactical and strategic allocation based on the product tree. It also provides information on open points, alerts, to-do lists, key performance indicators etc. - Analysis

Create risk/return analyses based on return on investment and customer-specific risks (PEP). Effective analysis tools help to define, measure and explore the potential of individual customers. - Segmentation

You can divide your customer portfolio into segments, allocate potential customers and monitor the sales process by evaluating each customer in terms of return on investment, income development and potential for new business (net new investments, asset inflows). Performance metrics can be defined for individual clients, aggregated and aligned with market and regional objectives and business plans.