Portfolio Management

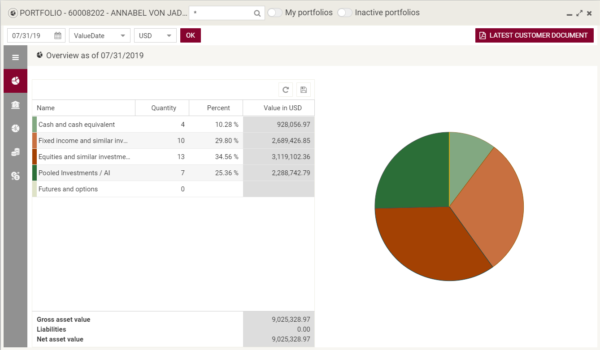

Portfolio Analyzer – Detailed Asset Analysis

- Client Usability

Asset classes encompass security positions, accounts and contracts. The asset analysis provides grouping, sorting and filtering of all portfolio positions for all available asset characteristics. The valuation is calculated from individual data and can be done on a value, book or trade date basis. The look and feel of the asset tableau is customizable individually and the setting can be stored on client level.

- Product Categorization

The product tree is built by your criteria. In addition, multi-level asset segmentation by asset classes, regions, currencies, risk currencies, sectors, ratings, maturities and risk classes is possible. Total product P&L is shown as well as P&L attribution by market and currency. Parameters such as duration, yield to maturity and standard deviation are calculated.

- Transaction Level Analysis

Drill-down is possible to the transaction level for all product types. Transactions can be grouped by transaction type and filtered by date.

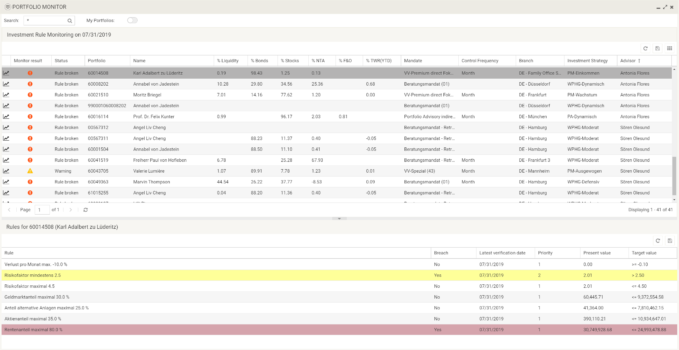

Portfolio Monitor – Overview Portfolio status

- Client Usability

The portfolio monitor gives an overview of the previous day’s rule check results. The overview shows portfolio details (mandate, strategy, advisor) as well as asset allocation and performance figures. The table provides grouping, sorting and filtering of all portfolio details as well as the respective portfolio rules and their results. The look and feel of the asset tableau is customizable individually and the setting can be stored on client level.

- Asset Segmentation

The portfolio overview can be switched between different views – grid, index cards with portfolio statics and index cards with portfolio details.

- Compliance Monitoring

The results of the automated monitoring of portfolio related investment directives for asset allocations is done overnight, the calculation of risk factors, control on thresholds, outperformance of benchmarks and black list controls are shown in natural language rules. Rule violations distinguish between “breach” and “warning”, giving more time to react.

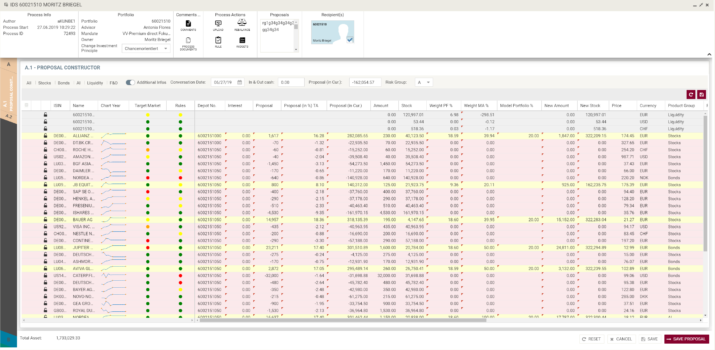

IDS – Investment Decision Suite

- IPP Investment Proposal Process

Process with automated generation of multiple investment proposals. Graphical comparison of before/after situation. Embedded Advisable and Tradable Universe (fully customizable). The generated system proposals can be downloaded as PDF or as an editable PowerPoint document. - IAP Investment Advisory Process

This tool enables the automated creation of multiple investment alternatives, the automatic rebalancing of one or more portfolios against a model portfolio and the automated creation of the order list. - PMP Portfolio Management Process

One step management of a multitude of discretionary portfolios linked by a strategy. Rebalancing of the virtual strategy position against the strategy model portfolio in consideration of portfolio specific constraints. Automated generation of blockorder and allotments.

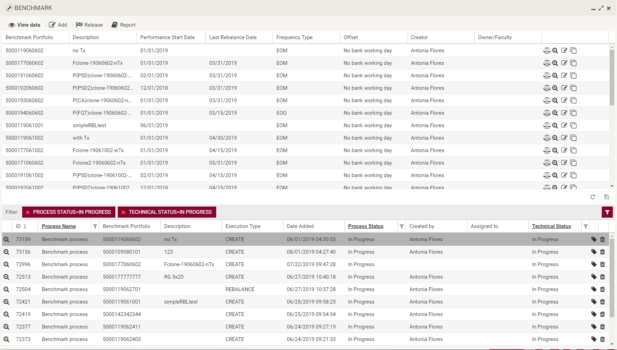

Benchmark and Model Portfolio Management

- Business Process

Fully automated creation and rebalancing of benchmark portfolios based on different constituents (indices, securities, own calculation models, etc.). Role based process model encompassing all involved business units (advisor, back office). Easy assignment of benchmark to client portfolios. - Security and Reliability

Automated and documented process at any given time. 4-eyes principle for every major process step. - Process Efficiency

Fully automated, scheduled generation of rebalancing transactions. - Process Flexibility

Automated creation of control lists. Free choice of rebalancing frequencies (daily, weekly, monthly, quarterly, semiannually, annually or ad hoc) supported through the banking calendar. Easy exchange of constituents and cloning of benchmark portfolios.

Management of Static Product Data – tradable and recommended investment instruments

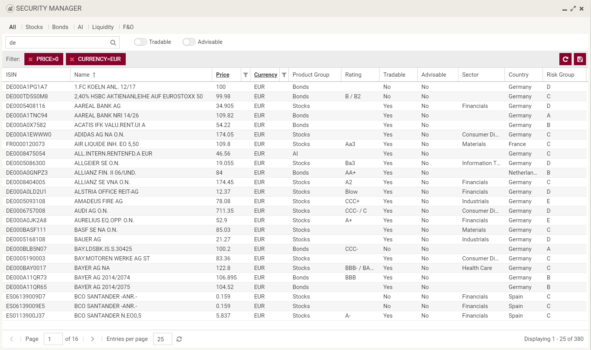

- Security Manager

The security manager provides a quick overview of all available investment instruments. Tools like filtering, sorting and grouping give an advisor all possibilities to find a single instrument or a variety of compliant instruments for his special needs with a few clicks. Search for an individual instrument by name or ISIN. - Integration with Other Processes

Drag and drop one or more selected securities into other application areas such as Investment Decision Suite (IDS), Client Advisory Process (CAP) etc. - Filtering by Main Asset Classes

Support of integrated pre-filters for tradeable and advisable universe.